If you happen to be a fan of the heavy metal band Isis (an unfortunate name, to be sure), you may have trouble ordering its merchandise online. Last year, Paypal suspended a fan who ordered an Isis t-shirt, presumably on the false assumption that there was some association between the heavy metal band and the terrorist group ISIS.

Then last month Internet scholar and activist Sascha Meinrath discovered that entering words such as "ISIS" (or "Isis"), or "Iran", or (probably) other words from this U.S. government blacklist in the description field for a Venmo payment will result in an automatic block on that payment, requiring you to complete a pile of paperwork if you want to see your money again. This is even if the full description field is something like "Isis heavy metal album" or "Iran kofta kebabs, yum."

These examples may seem trivial, but they reveal a more serious problem with the trust and responsibility that the Internet places in private payment intermediaries. Since even many non-commercial websites such as EFF's depend on such intermediaries to process payments, subscription fees, or donations, it's no exaggeration to say that payment processors form an important part of the financial infrastructure of today's Internet. As such, they ought to carry corresponding responsibilities to act fairly and openly towards their customers.

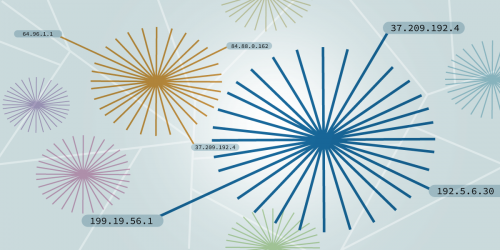

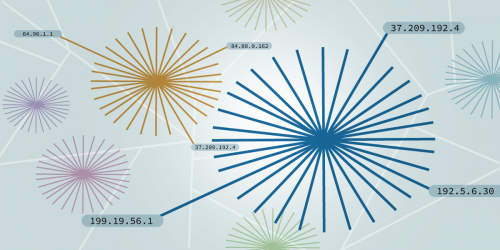

Unfortunately, given their reliance on bots, algorithms, handshake deals, and undocumented policies and blacklists to control what we do online, payment intermediaries aren't carrying out this responsibility very well. Given that these private actors are taking on responsibilities to help address important global problems such as terrorism and child online protection, the lack of transparency and accountability with which they execute these weighty responsibilities is a matter of concern.

The readiness of payment intermediaries to do deals on those important issues leads as a matter of course to their enlistment by governments and special interest groups to do similar deals on narrower issues, such as the protection of the financial interests of big pharma, big tobacco, and big content. It is in this way that payment intermediaries have insidiously become a weak leak for censorship of free speech.

Cigarettes, Sex, Drugs, and Copyright

For example, if you're a smoker, and you try to buy tobacco products from a U.S. online seller using a credit card, you'll probably find that you can't. It's not illegal to do so, but thanks to a "voluntary" agreement with law enforcement authorities dating back to 2005, payment processors have effectively banned the practice—without any law or court judgment.

Another example that we've previously written about are the payment processors' arbitrary rules blocking sites that discuss sexual fetishes, even though that speech is constitutionally protected. The congruence between the payment intermediaries' terms of service on the issue suggests a degree of coordination between them, but their lack of transparency makes it impossible to be sure who was behind the ban and what channels they used to achieve it.

A third example is the ban on pharmaceutical sales. You can still buy pharmaceuticals online using a credit card, but these tend to be from unregulated, rogue pharmacies that lie to the credit card processors about the purpose for which their merchant account will be used. For the safer, regulated pharmacies that require a prescription for the drugs they sell online, such as members of the Canadian International Pharmacy Association (CIPA), the credit card processors enforce a blanket ban.

Finally there are "voluntary" best practices on copyright and trademark infringement. These include the RogueBlock program of the International Anti-Counterfeiting Coalition (IACC) in 2012, about which information is available online, along with a 2011 set of "Best Practices to Address Copyright Infringement and the Sales of Counterfeit Products on the Internet," about which no online information is found. The only way that you can find out about the standards that payment intermediaries use to block websites accused of copyright or trademark infringement is by reading what academics have written about it.

Lack of Transparency Invites Abuse

The payment processors might respond that their terms of service are available online, which is true. However, these are ambiguous at best. On Venmo, transactions for items that promote hate, violence, or racial intolerance are banned, but there is nothing in its terms of service to indicate that including the name of a heavy metal band in your transaction will place it in limbo. Similarly, if you delve deep enough into Paypal's terms of service you will find out that selling tickets to professional UK football matches is banned, but you won't find out how this restriction came about, or who had a say in it.

Payment processors can do better. In 2012, in the wake of the payment industry's embargo of Wikileaks and its refusal to process payments to European vendors of horror films and sex toys, the European Parliament Committee on Economic and Monetary Affairs made the following resolution:

[The Committee c]onsiders it likely that there will be a growing number of European companies whose activities are effectively dependent on being able to accept payments by card; [and] considers it to be in the public interest to define objective rules describing the circumstances and procedures under which card payment schemes may unilaterally refuse acceptance.

We agree. Bitcoin and other cryptocurrencies notwithstanding, online payment processing remains largely oligopolistic. Agreements between the few payment processors that make up the industry and powerful commercial lobbies and governments, concluded in the shadows, can have deep impacts on entire online communities. When payment processors are drawing their terms of service or developing algorithms that are based on industry-wide agreements, standards, or codes of conduct—especially if these involve governments or other third parties—they ought to be developed through a process that is inclusive, balanced and accountable.

The fact that you can't use Venmo to purchase an Isis t-shirt is just one amusing example. But the Shadow Regulation of the payment services industry is much more serious than that, also affecting culture, healthcare, and even your sex life online. Just as we've called other Internet intermediaries to account for the ways in which their "voluntary" efforts threaten free speech, the online payment services industry needs to be held to the same standard.